Written by Mark A. Alexander

Texas Trial Attorney | 30+ Years of High-Stakes Litigation Experience

Updated: February 5, 2026

In the world of Texas oil and gas, the silence is often more expensive than the noise. If you are reading this, you are likely experiencing a “glitch” in your investment. Perhaps the monthly reports have become vague, the operator has stopped answering your calls, or the payouts have stalled entirely.

At Mark A. Alexander, P.C., we don’t just provide a quick answer—we provide Strategic Counsel. When an investor contacts us for a High-Stakes Evaluation, our approach is forensic and methodical. We don’t just read the geologist’s report; we verify the professional credentials.

We don’t just look at the drilling logs; we examine the flow of capital. We utilize over 30 years of high-stakes commercial litigation experience to identify the path of the investment and determine the most effective legal response for your specific situation.

The Forensic Deep-Dive: 5 Clues You Can’t Ignore

1. The “Guaranteed Strike” Fallacy After over 30 years of high-stakes commercial litigation, one red flag appears consistently in energy deals: the “guaranteed” strike. While modern technology has advanced operational efficiency, a legitimate geological evaluation is grounded in probability and data—not certainty. If an investment pitch includes claims of “no downside,” the promoter is likely hiding the risk rather than removing it. Under current regulatory standards and Texas state law, the promise of a “Guaranteed Strike” warrants an immediate professional evaluation.

2. The Payout “Technical Glitch” Fraudulent deals often start with a small, early “interest payment” designed to build trust for a larger investment—this is known as “The Hook.” But when the primary capital is committed, the Silent Stall begins. You start hearing about “banking delays” or “software updates.” A technical glitch is a one-day event. A “glitch” that lasts two weeks is a clear signal that the promoter is stalling while they plan an exit. This is the moment where strategic counsel becomes critical.

3. The Transparency Gap A legitimate operator provides Private Placement Memorandums (PPMs), audited financials, and verifiable drilling logs. If your request for these documents is met with hostility or claims that “this is a private, family-office style deal,” the lack of transparency is your loudest warning. In the Texas energy sector, transparency isn’t a courtesy—it is a legal requirement under the Texas Securities Act.

4. Complex and Layered Structures Sophisticated fraudsters may use complex royalty structures or multiple layers of anonymity to obscure the flow of capital. These structures are often designed to make asset recovery significantly more difficult once a dispute arises. If the deal’s structure requires a 20-page diagram to explain, it is likely designed to confuse your judgment, not protect your capital.

5. Unsolicited “Exclusive” Pitches Legitimate, high-yield energy deals do not typically seek out retail investors via unsolicited social media ads or “investor group” Telegram chats. If an “exclusive” opportunity finds you, you aren’t the investor—you are likely the asset being harvested. We utilize our forensic background to identify these patterns and provide the strategic counsel necessary to protect your interests.

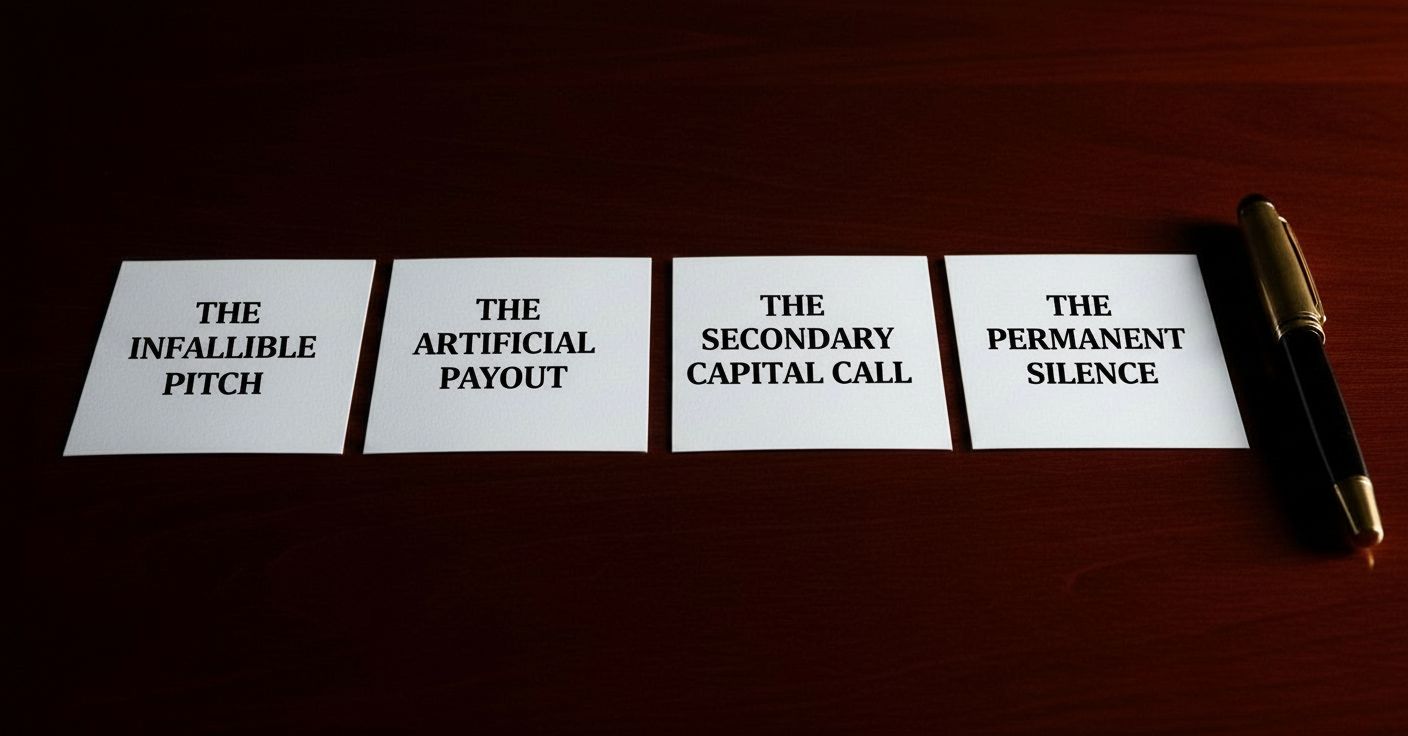

Strategic Triage: Identifying the Lifecycle of an Investment Scammer

Fraud follows a predictable pattern. Understanding where your investment sits on this timeline is the first step in Strategic Counsel. Our forensic evaluation identifies the specific stage of the lifecycle to determine the most effective path toward recovery.

Lessons from the Norman V. Meier Investment Scammer Case

The Norman V. Meier case remains a critical study for the 2026 investor. Meier utilized a polished persona and “insider” information to siphon over $10 million from unsuspecting victims. He utilized many of the tactics we see today: a polished persona, “insider” information, and a narrative of guaranteed wealth. The lesson isn’t just that scammers lie—it’s that they rely on your silence.

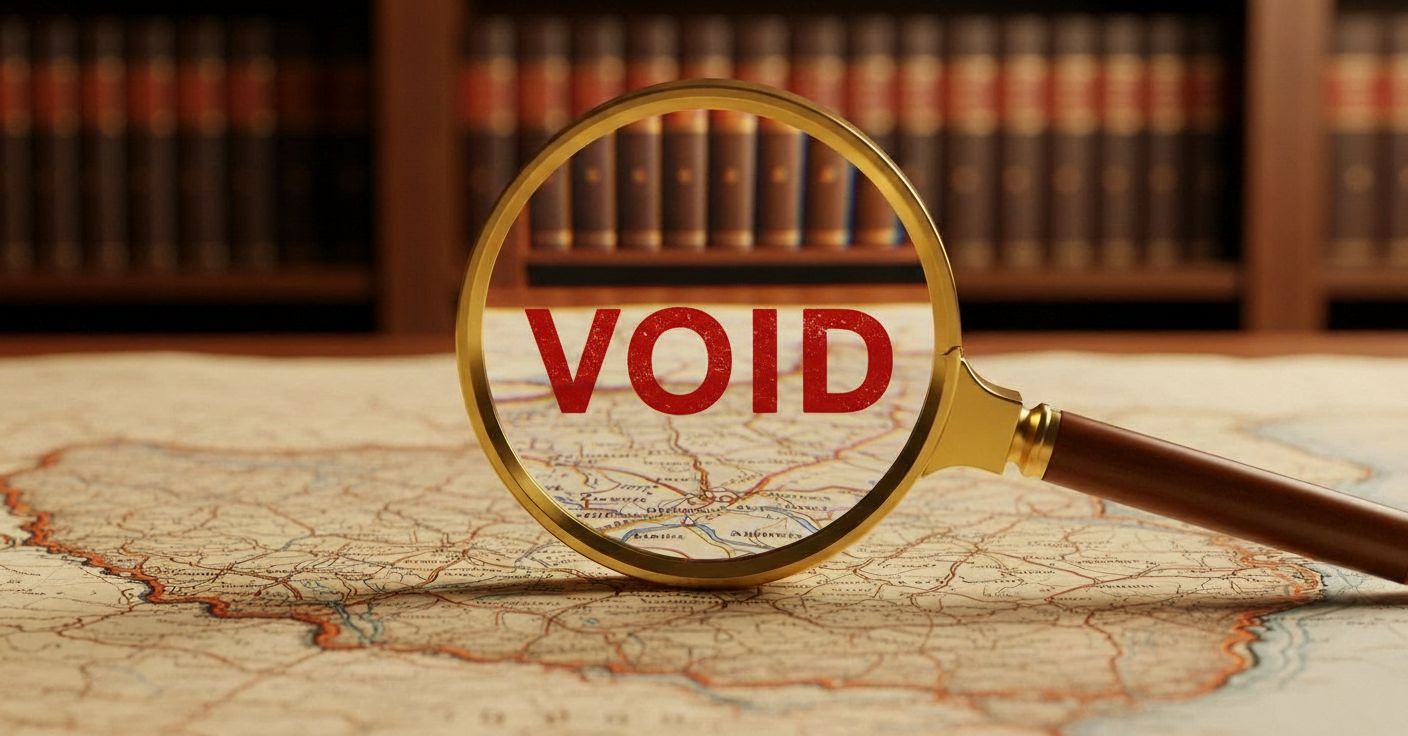

This is a classic tactic used by the modern investment scammer: creating an information “void” and filling it with high-pressure persuasion to prevent a forensic review of the facts.

Deep-Dive Scrutiny: Finding the “void” in the promoter’s data.

Deep-Dive Scrutiny: Finding the “Void” in the Promoter’s Data

In high-stakes energy investments, the most critical data is often found in what is missing. Scammers and deceptive promoters rely on the “Information Gap,” assuming that investors will focus on the polished marketing deck rather than performing a forensic review of the actual Joint Operating Agreement (JOA).

Identifying the “void” is the core of our Strategic Counsel. We look specifically for the silent removal of protective provisions, such as the Maintenance of Uniform Interest (MUI) clause, or the lack of verifiable licensure through the Texas Board of Professional Geoscientists. When these contractual safety nets are stripped away, the investment is no longer a business venture—it is a wealth extraction scheme.

We utilize our forensic background to identify these technical “voids” before the promoter reaches the final stage of the fraud lifecycle.

The MUI Principle: Why Uniform Interest Matters

Beyond the persona, a sophisticated investor must examine the Maintenance of Uniform Interest (MUI) provisions within the Joint Operating Agreement (JOA). In legitimate Texas energy ventures, the MUI ensures that all parties maintain a consistent percentage of interest across the entire contract area.

The red flag occurs when promoters bypass or “strip” these provisions to dilute your position while maintaining their own “carried interest” at your expense. If your promoter cannot explain how the MUI protects your specific acreage, the Strategic Counsel is clear: you are likely a source of liquidity for their next exit rather than a partner in production.

The 2026 Texas Business Court Advantage

As of early 2026, the new Texas Business Courts are fully operational, fundamentally changing the landscape for victims of a sophisticated investment scammer. Historically, multimillion-dollar oil and gas disputes were often litigated in rural counties alongside general civil and criminal matters. Today, for high-stakes energy fraud cases meeting the jurisdictional threshold—recently lowered to $5 million—these specialized courts provide a forum where judges with deep commercial expertise preside.

This shift means that the Strategic Counsel we perform today determines whether your case qualifies for this expert-led, expedited track. In the hands of a professional investment scammer, capital is moved quickly; the Business Courts are designed to match that speed with judicial efficiency. With over 30 years of high-stakes commercial litigation experience, we understand how to navigate these new procedural nuances to protect your capital and pursue a recovery.

The Clock of Repose

In Texas, the timeline for filing energy-related claims is governed by strict statutes of repose. Unlike standard statutes of limitations, these windows are absolute. Understanding your leverage before these windows close is a critical component of strategic counsel.

Strategic Counsel: Recovering from an Investment Scammer

When an investment shifts from a “proven strike” to a “technical glitch,” your role as an investor changes. You are no longer evaluating a business opportunity—you are managing a potential legal recovery.

Oil and gas litigation requires more than contract law knowledge. It demands a forensic evaluation of geological reports, Joint Operating Agreements, and the specific deceptive tactics modern promoters employ. Mark A. Alexander, P.C. provides over 30 years of experience in high-stakes commercial litigation. We offer the Strategic Counsel necessary to identify where capital went and determine which legal remedies are available under the Texas Securities Act.

In 2026, waiting for promoters to “make things right” rarely succeeds. Recovery requires a methodical evaluation of the investment’s lifecycle to determine if legal action is warranted.

Official Investor Resources & Protection

- Texas State Securities Board: The primary authority for investor protection in the State of Texas.

- SEC PAUSE Program: A database of unregistered entities that falsely claim to be licensed or located in the U.S.

- FINRA BrokerCheck: Use this tool to verify the registration status and disciplinary history of any investment promoter.

- Texas Board of Professional Geoscientists: Verify the license and standing of any geologist providing technical reports for an energy project.

Strategic Evaluation

Is your investment telling you a story? Request a Strategic Evaluation of your Joint Operating Agreement.

Direct Office Line: (972) 544-6968

Disclaimer: Informational purposes only. No attorney-client relationship formed. Prior results do not guarantee future outcomes. Attorney Advertising.